Accounting codes have mystified many dental teams throughout the years, and today we’re going to demystify them for you.

So, what are accounting codes? We use the words “accounting codes” to mean any code that is in a dental office’s financial system. A general ledger (GL) code, a location code, a vendor code, and a specialty code (or class) are all different types of accounting codes. Accounting code is simply the umbrella term that covers all of these codes.

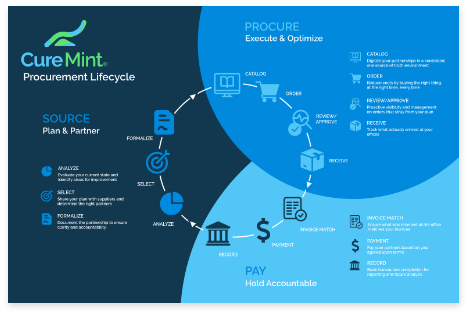

Accounting codes are part of the very last step of the dental procurement lifecycle for your dental practice. They are the key to mapping every purchase within your financial system, creating a cloud-based record of all your spending.

With that in mind, let’s dive into the different types of accounting codes and what they mean.

1. GL Code

A GL code stands for general ledger. This is a code that exists in a financial software system like Quickbooks, Sage Intaact, or NetSuite. GL codes are used to identify where spend is going for given products. By associating a specific GL code with a specific product, you can properly allocate spending within your financial system after making a purchase.

Each line item on a purchase order can be classified into some general ledger category to create a GL code that tags spending by the individual product. For example, let’s say you assign GL code “6301” for burs. With dental procurement software, you can then associate the product SKU for burs with the code 6301. The result is that whenever someone at your organization purchases burs, the corresponding GL code gets mapped into your financial system so that you can quickly identify how much is being spent on what. This simple automation can save your AP team from dozens of hours of manual work each month!

2. Location Code

Location codes are a unique identifier for each office. When a specific office within a dental organization buys something, it’s important for the finance team to be able to track it in their system. Location codes help identify which office is spending what.

The dental supply vendors that you purchase supplies from also use location codes, as these are easier to manage than physical addresses (it’s less bothersome to transfer a number back and forth across systems than a multi-string address).

It is likely that your financial system incorporates location codes allowing you to record spending from each office. In time, once you start using location codes for every order and create a single source of truth for your organization’s spending, it becomes much easier to identify the trends, patterns, and cost savings opportunities that will help increase your dental practice’s bottom line.

3. Vendor Code

Vendor codes are another type of accounting code. Vendor codes serve to identify vendors within your financial system. In other words, vendor codes help you know, “Who did we buy this from?”

Imagine a procurement ecosystem where, at any one time, you knew how much money was spent with any one of your vendors. A dental procurement solution with vendor codes helps you do that by classifying specific products and extracting the data once a purchase is made. Understanding how much your offices are spending with each vendor is a crucial step in the 9 Step Guide to Reducing Dental Supply Costs.

4. Specialty Code

Specialty codes are the fourth and final accounting code dental teams need to know. In the accounting world, specialty codes are referred to as “classes.” Each specialty class represents a different branch (or wing) within a dental practice.

Specialty codes exist because some dental offices have multiple specialities, such as orthodontic, pediatric, general, etc. If someone is buying gloves for this office, it’s helpful for accounting teams to know which specialty is purchasing the item. Maybe this time you’re spending money for pediatrics, but the next time it’s for orthodontics.

Assigning specialty codes to each order helps to allocate the spend within an office into separate buckets. This way you can drive meaningful insights into the decision making and purchasing process at each individual office in your organization. Perhaps the data reveals that a certain specialty is overspending on dental supplies. Specialty codes give you the information needed to create dental specialty budgets that control spending and guide smarter purchasing decisions.

Track Spending from Purchase to Invoice

If you aren’t sure how to get started with spend management for your dental practice, but you’re up to speed on your financial system, then accounting codes might be a good place to begin. While all the different accounting codes may seem confusing at first, once you start to understand the meaning behind each one, they are actually very easy (and quite powerful) to use. All it takes is an all-in-one procurement solution like CureMint to design your very own procure-to-pay ecosystem that automatically tracks office spending for you – from the point of purchase all the way to your accountant’s desk.

Interested in learning more about dental spend management with CureMint? Sign up today for a free demo.

Related Blogs

Using Big Data to Lower Dental Supply Costs

09.28.21

As the dental market surpasses $150 billion and private…

Not All Dental Costs Are Equal: Which One Are You Focusing On?

09.27.21

It doesn’t matter whether you’re whitening teeth or selling…

Is Your Dental Practice Dripping Away Dollars on Invoice Processing?

08.24.21

Invoicing. It’s one of the most unavoidable parts of doing…